Cross-border on Chinese eCommerce Platforms

More than 14,500 foreign brands from 63 countries are selling on Chinese eCommerce platforms, and more than half of these brands have their presence on Tmall International platform. Two major reasons for this emergence of foreign brands on Chinese eCommerce platforms are: growing demand of foreign products, and relaxed policies on consumers purchasing personal items from foreign website.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

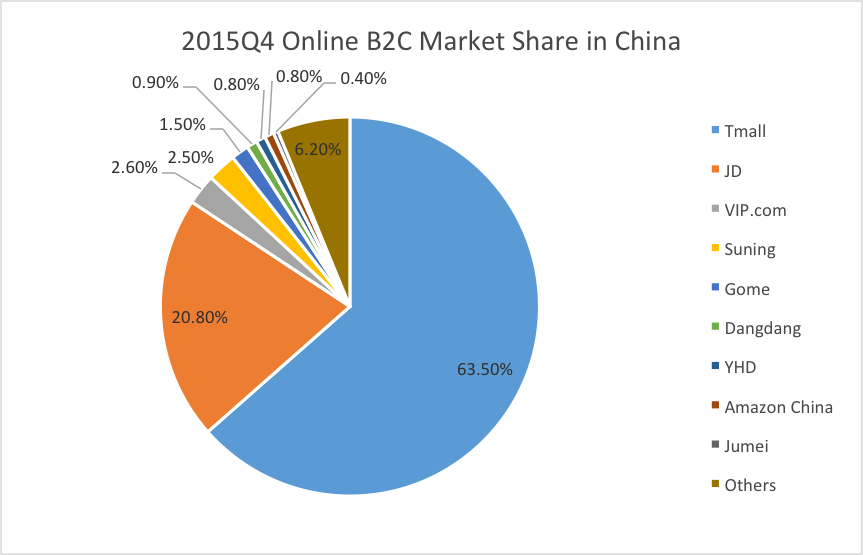

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

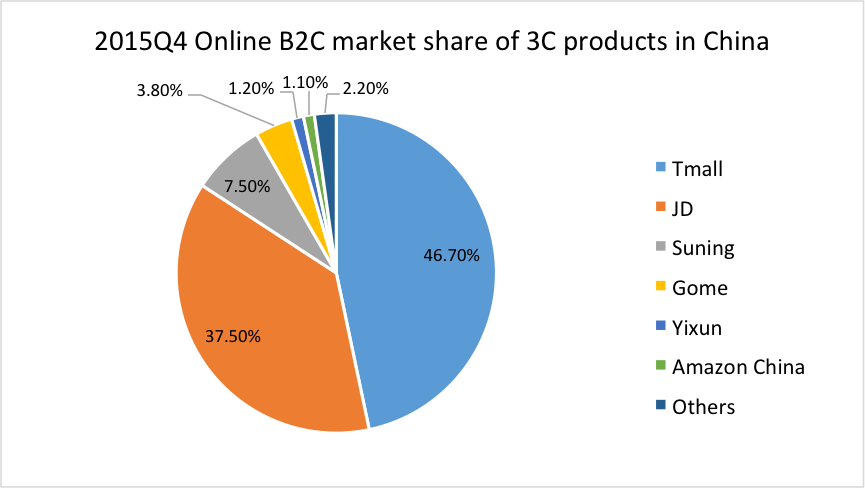

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

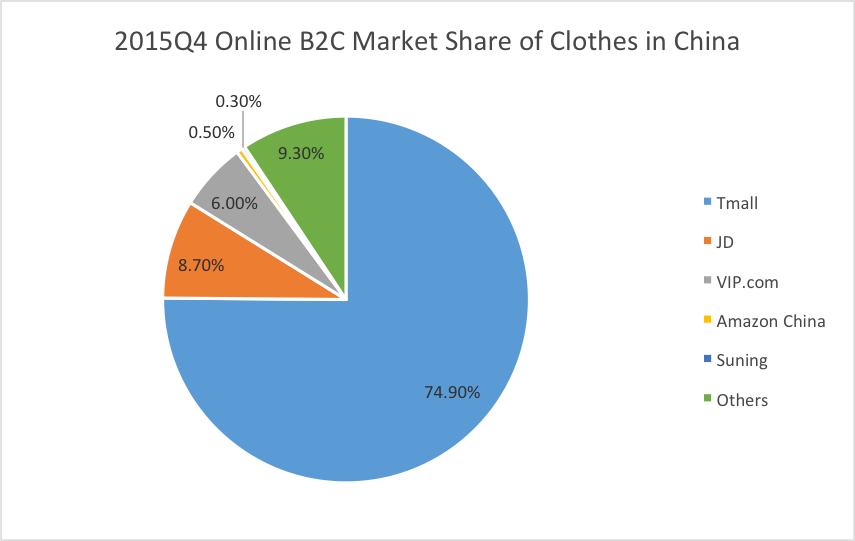

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

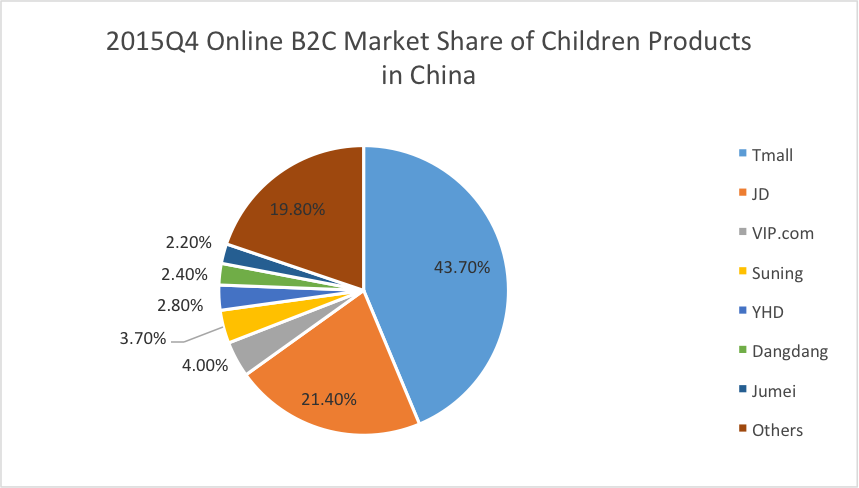

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

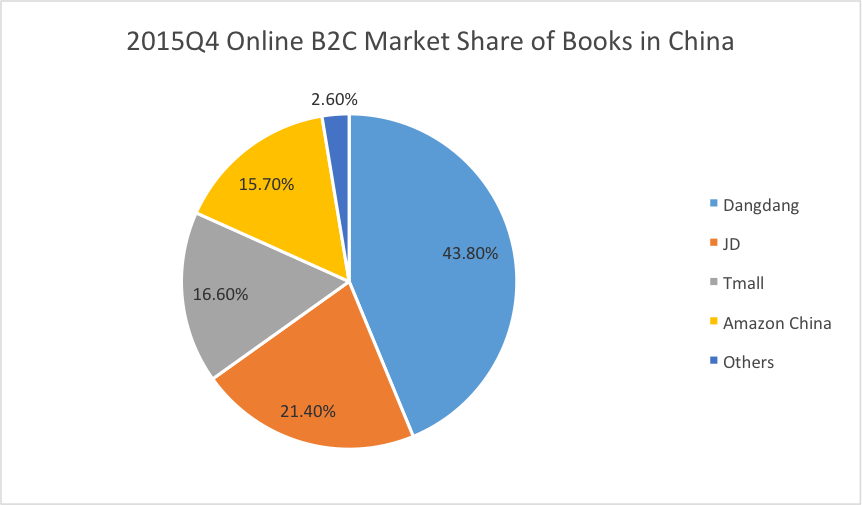

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from:

All you need to know about Ecommerce in China

The first quarter of 2016 is already behind us, are you still figuring out how to start your e-commerce business in China? For some of us e-commerce still feels like a new business model, however, China has long passed this stage, various data suggests that it has already become a traditional industry in China. Traditional or not, let us sort out the current e-commerce situation and forecast its areas of development.

Ecommerce is on its way to become a traditional industry in China

Ten years ago the ecommerce in China was brand new. Taobao was the most popular C2C online platform. At that time, people who had the technical skills and knowledge of search engines could get over 80% of return of investment on a Taobao shop. Nowadays, Taobao offers more than 1 billion products, has over 10 million sellers, and around 320 million active users. These huge numbers only come from one of Alibaba Group’s marketplace so you might be able to reckon the whole picture. After ten years high-speed development, China’s ecommerce is not a new industry anymore; its development is now as mature as the real estate or the catering industry.

Traditional industry vs Ecommerce

In recent years, the traditional industry has been strongly affected by the online market, some companies have managed to adapt their business to the new online scene, but some have failed at this task. This trend of transitioning from offline to online businesses will speed up this year, and although there are currently more traditional businesses than online ones, online businesses will eventually catch up.

It seems that both business models cannot co-exist, however, if the resourceful traditional industry would explore Chinese digital marketing and ecommerce solutions, they would be able to achieve better results with half the effort.

Develop a 020 (Online-to-Offline) business model

In coming years, online retailing will be a fully integrated part of the market, it will help companies grow, and sale more efficiently. On the other hand, they will also have to implement the offline part of it, a successful integration of a good O2O business will, without a doubt, thrive in market. Suning began handling deliveries for Alibaba, in order to push Tmall Supermarket into the massive market, and Jingdong is promoting Jingdong Daojia, all the actions from the leading Ecommerce companies indicate that the O2O model is inevitable to come.

Ecommerce in the rural areas

Last year ecommerce in rural areas had a rapid development. Alibaba made a long-term project to promote online shopping in order to expand its business coverage. The central government formally issued a document to help the promotion of rural ecommerce and facilitate the integration of online and offline. Alibaba, Jingdong and Suning are also pushing the development of ecommerce in rural areas so we should expect an huge increase this year.

Great development of CBEC (cross-border ecommerce)

Over the past 2 years, CBEC has become one of the most popular business models in China. It has given import business a lot of opportunities; moreover, since the Chinese middle class has grown considerably (first place in the world with over 100 million), it turns out to be a very profitable business. The main consumers are people between the ages of 30-40 and have great acceptance for foreign products, this will bring a lot of overseas ecommerce companies into the Chinese market.

Here at 2Open we specialize in ecommerce and digital marketing. Our goal is to understand our clients business needs in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

Jumpstart your E-commerce business in China

E-commerce in China is growing so rapidly and it appears to have big rewards for those who manage to thrive in the market. Problems for companies who want to enter China arise due to limited knowledge about the Chinese market and the variety of e-commerce platforms, but how exactly should you start your e-commerce business in China? Where should you start?

Indeed, there are countless B2C (Business-to-customer) e-commerce platforms in China, Tmall/Taobao are in the leading position, followed by JD, then VIP.com, Suning, Gome, Dangdang, YHD, Amazon China, and so on. Usually each platform has a deposit, some annual fees, and commissions. If your are starting your e-commerce business opening a Tmall/Taobao shop first would be a smart move from your part, later, when your business grows, you could extent and broaden your sales channels. You might be wondering, Why Tmall/Taobao? Why here and not in other platforms?

Firstly, let us look at this from an investor’s point of view, minimizing initial investment. For a Tmall shop different products and shop types have different deposit amounts that range from 50,000 RMB to 150,000 RMB. The annual service fees are 30,000 RMB or 60,000 RMB depending on the category, they may be half or totally refunded if the business is good enough to reach certain revenue. As for the commissions, different categories also have different commission rates, commissions in Tmall start from 0.5% to 5%, this is quite competitive since other usually range from 10% to 15%. After all, Tmall is mainly an open platform for all vendors.

Some small companies or cautious companies should consider starting with a Taobao shop. Taobao is supposed to be a C2C platform, since its requirements, compared to the ones of Tmall, are considerably lower, some small companies opt to start with a Taobao shop first. Why is this option so appealing to small companies? There are two types of Taobao shops to choose from, the first one is owned by a person and the second one is owned by a company. The personal Taobao shop can be upgraded into a company account if the owner is the legal representative or a shareholder. The best thing about Taobao is that it is free, you only need 1000 RMB as the deposit and Taobao has no annual fees or commissions. For those who are really cautious or lack resources, this might turn out to be a wise choice.

Secondly, let us analyse the human resource factor. You might have agencies working for you or maybe a few employees; however, trying to start with all channels at once may not always be the best option for your business. To successfully manage an e-commerce shop it takes dedication and time, even though opening a shop is not a difficult task, managing that shop is. Analyse, optimize traffic and content, and increase sales is something that requires time and focus. The target is to turn those open channels into productive channels, it is worth mentioning that most of these e-commerce platforms are similar or even copy Tmall/Taobao, so getting familiar with platforms is kind of like getting familiar with the e-commerce industry in China.

How is the e-commerce environment looking in China? Tmall/Taobao have been leading the free traffic in China for years, each day there are more than 40 million visitors on Taobao. Even Suning, Dangdang, YHD and Amazon China now opening their shops on Tmall.

As for the payment side, Taobao/Tmall have their own payment method, Alipay. With more than 0.3 billion registered users, 0.27 billion active users, and links to over 180 banks both in China and other countries, Alipay is the largest third party online payment platform in China, some active users even use Alipay to pay for their home power, gas and water fees. It makes it easier for consumers to pay.

Finally, let us discuss product control. Since Tmall/Taobao are mainly open platforms, vendors have almost fully control of their products. You can categorize the type of product your selling, upload or remove it anytime you want and also have full control of the price and logistics company you want to use to deliver your products.

So if you are planning on entering the Chinses market through e-commerce you might want to start with a Tmall or Taobao shop first. Here at 2Open we specialize in digital marketing and e-commerce, our goal is to understand our clients business needs, in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

References:

General situation of fake products in China

It is common knowledge that fake products are everywhere in China, from large cities like Shanghai to remote small towns in Western China and, not surprisingly, online markets are not the exception, even though there is a lack of acknowledgment from their part, it seems that fake products are a part of China whether we like it or not.

The online market giant Alibaba group was sued in the U.S. regarding fake products regulations. According to Jack Ma, the founder of Alibaba, his company spends over one hundred million RMB each year on actions against counterfeit goods. The situation has improved considerately over the past few years, some shops have even been closed down due to this sort of issues. 2Open, as a company who deals everyday with marketing and e-commerce, is used to supervise online sales in China for many clients and the number of shops selling a certain brand with an unbelievably lower price has decreased noticeably in comparison with last year. There is still a lot of work to do, but exactly what types of products are more likely to be faked?

SHENZHEN, CHINA – AUGUST 04: (CHINA OUT) Police officers deal with fake brand-name items at a shop on August 4, 2014 in Shenzhen, China. Shenzhen police seized a large number of fake brand-name items, like Hermes, Gucci, Rolex, Chanel, Prada, Miumiu, and so on, worth 5,000,000 yuan (810,000 USD). (Photo by ChinaFotoPress/ChinaFotoPress via Getty Images)

The most common faked goods are well-known brands, such as Nike, Adidas, Louis Vuitton, Gucci, etc. If a new brand wants to enter China, it will seldom encounter issues regarding fake products. In this situation, just a small budget is needed for online marketing which could be used for setting up a shop on www.taobao.com, putting online Ads or even buying key words on search engines, all of which can have a positive effect and lead buyers to get to know your brand. Since you are the shop owner and the only supplier at this moment, the buyer will come to you directly; no other shops will take potential buyers from you.

Let us say your brand successfully entered the Chinese market, perhaps one day someone will start faking and selling your products, but how would this affect your brand? Some argue that this is just indicator of the success and popularity that your product has had in the Chinese market and that there are no reasons to be worried. Experts agree that there is plenty of space in the market for both parties; a lot of people prefer to buy original products for a higher price than fake ones for a lower one. Counterfeiting could be considered a promotion activity for a brand, after all, if you are confident about your products, put money into marketing, let people know about it, you will get money back, no doubts about it, but how is the future looking for fake goods?

According to Xinhuanet, the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) has gathered around four giant e-commerce platforms: Alibaba, Jingdong, Suning, Yihaodian to sign a cooperation agreement which will help to release inspection results of the fulfillment of product quality commitment. AQSIQ has developed a search platform of inspection of product quality, which will be put online for public use around March 15, 2016.

Fake products problems continue to plague the development of e-commerce. Jingdong and Alibaba have been fighting a war these days, accusing each other of not making efforts to end the fake goods. The offline scene does not look very bright either, street shops are now going through a rough time these days, people are getting used to purchase everything online, from groceries to electronics, during the singles day alone (Nov. 11, 2015) Taobao reached a sales volume of 91,217,017,615 RMB.

It is an Internet Era, no doubt about it, and counterfeit goods should not represent any obstacle if one should intent entering the Chinese market. A smart digital marketing strategy, like the one 2Open offers, can get your brand the recognition it deserves.

Let us know what you think in the comments below.

This article was edited by Andres Arroyo from 2Open.