Can Specialist Retailers Survive against Alibaba and Amazon?

It is said that whoever hits first, hits twice. Some days ago, Zalando signed a partnership with its biggest competitors, Amazon and Alibaba. Far from thinking that they were wrong, we feel confident about the future of these new alliances between Europe, China and United States.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Although originally its activity was focused in marketplaces, in 2010 Zalando starts its jump into developing and selling its own brands. Online selling shoes, clothes and fashion items constitute the core of the company, under a cross-platform perspective.

A step to break: boundaries to online shopping

Even if such perspective still remains today, observers enjoy its dramatic effects: to an unique Refund – Return policy in retail and a highly attractive shipping, have joined an effective logistic management and a recent prospection in offline context.

Although timidly, its development in the offline environment constitutes a new movement to establish its brand in the retail market and its visibility on some physical multibrand markets in Germany. To this point is joined an attractive shipping policy that enhances its appeal to the consumer: it is fast, secure and in case the users feel dissatisfied with their purchase, they have the chance to return them within 90 days.

Even if its payment and reimbursed model is constantly criticized for its high risk, it is also truth that this pillar has become an emblem for Zalando, its trademark and distinction over its competitors.

Zalando pushes online to grow

The company shows a steady growth in its presence in Europe, while designing its jump to the international area. The future seems promising according to their latest analysis prospects, with a year revenue growth close to 20%.

This rise is the result of three main reasons:

- Its total adaptation to mobile user experience: U-commerce is the new king in sales –check our articles “How to Take Advantage of the Latest E-commerce Revolution? U-commerce Trend” and “5 Things to Avoid When Doing Business in China” to discover a bit more!–

- Mobile purchases are already more than half of its sales

- A wide range of products and therefore, a great audience to address

- Its advantage of using a vast network of online platforms

A twist to Ecommerce

The desire of the Group is boosting its international sales and take advantage of the huge possibilities that the electronic market and their highly developed logistics presents to them.

To achieve its goals, Zalando has woven alliances with the giants of E-commerce: Amazon and Alibaba. Although its presence on Tmall is expected for the coming months, its bet for B2C trade -previously discussed by us in our article “Do Other Ecommerce Platforms Stand a Chance Against Tmall?”- some steps further on international distribution are already in discussion.

It is worth noticing that this giant enterprises are transforming traditional business into a new business model. Digital Marketing and Ecommerce helps to create new partnership systems for other companies around the World, and it will become more and more important in the following years.

In search of a Digital and Ecommerce Company? If you have any question or require any information about our services,

Sources:

Spain and China, Allies but not Colleagues in Trade

This post comes to underline the strategy played by Spain on EU’s China policy, a role which has received virtually no attention so far, as well as the major reasons why Spanish e-commerce is potentially attractive for Chinese companies.

Spain´s strategy is based on promoting a political resemblance with China in order to gain a preferential economic treatment, a plot which has led to disparate results for both China and Spain.

A general view of bilateral trade

Even though both countries feel friendliness each other, they do so for different reasons: Spain emphasizes on economic benefits, while China is interested on Spanish political weight on the European stage.

In the last thirty years, Spain has tried to turn China into a key-partner, with mixed results in practice.

- China is the 5th non-EU destination for Spanish exports

- China is the 1st non –EU origin of Spanish imports

- Spain is the 7th trade partner of China in –EU

- China is the 11th destination of Spanish exports

- China is the 14th destination for Spanish investment (less than 1% of total)

- Spain is the 9th destination for Chinese investment in -EU

When looking at the evolution, some positive trends can be underscore:

- Spain’s exports to China have double to 4 billion in 2014

- China’s exports to Spain are growing since 2013

- Both country´s exports are well diversified

After the financial crisis in the West, Spain has redoubled its efforts to trade with China. There is still a huge growth potential for both countries to further develop.

Political understanding to facilitate Chinese future investment

The difficulties encountered by the Spanish companies in their landing in China contrast with the political temperance shown by Spain in its approach to China. The policy marked by Spanish governments regarding its Chinese counterpart has never shown significant differences: whether the party in power, Spanish policy has always been the same.

Far from stagnating, Golden Visa and Spanish Treasury Bonds are just two examples shown by Spain to attract Chinese investors, as well as the constant reminder of its close ties in Latin America.

The potential of Spanish E-commerce: an opportunity for Ecommerce business

Comparing to other mature markets, there are still loads of fresh chances to seize in the country: Spain’s ecommerce market as a whole is relatively small.

According to the latest analysis –Ecommerce Europe ´14-, Spain is the largest Ecommerce market in Southern Europe, far from Italy (2nd) and Turkey (3th).

Around 60% of Spanish customers already shop online, spending on average € 900 per year. Moreover, more than the 60% transactions are cross-border: UE, US and China lead the Top-3.

Its growth potential can be prompted by some aspect anyone thinking on approaching Spanish ecommerce should take into consideration :

- Improvement in logistics

- Take an advantage of the lower cost for online marketing

- Customer acceptance of foreign W-shops

- Spanish consumers distrust on websites, so offering a secure payment method is a must. Paypal is the favorite of more than half of buyers

- Spain is the European leader in mobile usage, and keeps growing

- Spain is the best gateway to test Portugal and Latin American countries

The bilateral relationship between China and Spain is one of our tasks. Thanks to our understanding of the market, in 2 Open we can help you boost your digital business.

Leverage the benefits both countries offer to your company,

Visit us!

10 Things you Need to Know to Build a Chinese Website (Part 2)

In the first part of this article, we showed and identified 5 main points that differentiate a Chinese website from its western counterpart that we need to keep in mind in order to build a good one.

Let us summarize some of the main points addressed in the previous article:

- The style, design and structure are more complex and with much more information in opposition to the cleanness of the western websites

- In terms of user experience, Chinese are used to a great amount of links and keyword search boxes are the kings for navigation purposes

- Where to host your Chinese website is one of the first decisions to make. The most of the times we advise you to have a hosting in China. For that you will need a Chinese company to apply for an Internet Content Provider (ICP License)

- The Chinese Great Firewall blocks all websites that do not meet the content requirements that marks the Chinese government

- Your website needs to be ready to integrate with the main Chinese players. Google, Facebook and friends are banned in China; instead you will need to use the BATs (Baidu, Alibaba and Tencent).

After this little updating, we would like to further develop this post showing you 5 more crucial things to take in consideration when building a good Chinese website.

When building a chinese website, What else should I know?

6 – CHINA IS MOBILE. BE RESPONSIVE

Adapting our website to mobile is very important in any country, but in China is mandatory.

The Smartphone is, in many cases, the only way they have to access the Internet. Therefore Chinese users are much more familiar with the use of mobile devices. Keep in mind that almost the 50% of all Ecommerce transactions made in 2015 were done via mobile, compared to the also quite high 22% in the United States.

Don’t think any longer and start working on a nice mobile design… Mobile first!

7 – DOMAIN. WHICH ONE IS THE RIGHT OPTION FOR ME

In your approach to domains, three are the main options:

– Not that long ago, to have a .CN was a must. It was not possible to get it if you didn’t have a Chinese legal entity. This has changed over the time and now you can easily get a .cn domain, no matter where your company comes from, just providing a copy of your Company’s ID. As the Chinese international top level domain, your brand might be perceived as having a strong presence in China and might also bring some trust

– On the other hand, we have the .COM domain. Chinese Internet users are increasingly getting used to this domain. Major Ecommerce platforms like Tmall.com, JD.com or Sunning.com may bear much of the blame for this. It can be very good for foreign companies trying to sell their products in the Asian giant to have a .com domain as it might help to highlight the international feel of the brand

– .COM.CN is the ugly duckling in the middle still in use by many brands mixing the good things from the previous mentioned domains, but without reaching their full advantages. In any case it can also be a good solution.

Which language should I use?

Another point to think about is the language to be used. Does your brand have a Chinese name? Then you can also use its pinyin term. Pinyin is the romanization system for standard Chinese: Chinese search engines recognise the pinyin words in the URL and then link them to what they stand for in Chinese characters in order for the website not to lose coherence.

Our advice?

Don’t get crazy about the domain, they are usually not that expensive. So, in case you can afford it, try to get the three of them (.com, .cn and .com.cn), plus their pinyin variants and redirect them to the main one; depending on your strategy.

8 – CONTENT. DON’T GET LOST IN TRANSLATION

It is important to know very well your main target markets as the language will differ depending on it. It might be obvious to mention it, but it wouldn’t be the first time that a company’s target consumer is in Hong Kong, Taiwan or Macao and the language used for the website translation was simplified Chinese instead of traditional Chinese and the other way around. That is a major and silly mistake that takes a long time to revert.

I don’t want to mention either the fact that a Google translated web does not help at all, but I am doing it because I have seen too many. It is mandatory to let a professional team take care of the translations. In 2 Open we separate this process in three parts:

- Translation, interpreting the main message that the customer wants to transmit to the final customer, done by a marketing professional in our team

- External review, done by a professional translator outside the team

- Final review, done by another marketing professional in our team

You might not believe it, but in certain cases we still get minor complaints. This is because Chinese language can be interpreted in many different ways. Therefore translations are always a difficult point in the list.

Is Customization a mandatory requirement?

Let’s not forget about the Chinese cultural customization. Website localization embraces translating and localizing a site into different languages making sure all content (text, images and videos) is translated correctly in an accurate, cultural and technical manner.

As stated before when talking about content, we are also talking about images and videos. There are no written rules and it has similarities to the domain section we discussed above. There are brands like Nike or Zara that prefer to maintain their international feel using western models in their multimedia strategy. Many young Chinese users welcome this method, but not all of them. Depends on the strategy you want to follow.

9 – PAYMENT OPTIONS. CREDIT CARDS? NO, THANKS

In the previous post, we wrote about the BATs (Baidu, Alibaba and Tencent). In China, the online payments market is currently dominated by two of these two tech giants – Alibaba’s Alipay and Tencent’s WeChat payment with 49.2% and 20% market share respectively.

These companies try to increase their market share by adding more brands and merchants within their ecosystem; something that both companies effectively handle. Also cash is king, as cash on delivery holds a strong position. The fast and vast adoption of electronic payments via mobile is likely to counter this trend in due time.

It is actually China and not the US at the leading edge of the trends towards mobile payments technology. Just for putting an example, both WeChat and Alipay have long used the now famous QR codes to let Chinese netizens pay for purchases and transfer money. It seems they have jumped over some natural technological development processes. This kind of behaviours can be quite normal in undeveloped countries that start to grow very rapidly.

What happened is that they adopted the mobile payment technologies even before implementing some existing ones as a huge percentage of the Chinese population accesses the Internet via mobile devices.

Another tip?

Get ready to integrate Alipay in your website as first and mandatory option. And seeing how fast Tencent WeChat payment is growing, that would be your second natural option.

10 – SEO

Once your website is ready, you will need to submit it to Baidu creating a Baidu Webmaster Tools account (only available in Chinese). That way Baidu will be able to index the site properly and your great Chinese adventure starts!

Search engine optimization done in Baidu is not so very different as the one you could do for Google. Anyway, we would like to note a few differences I think you need to know:

– Meta description – unlike Google and Bing, Baidu still uses Meta descriptions as a ranking factor. Keyword targeted description match users’ queries and their demands, which would help with the click through rate (CTR).

– Indexation – Baidu’s web crawling bot, Baiduspider, is not as advanced as the one from Google. As a result, you will need to help Baiduspider to discover and index your pages in different ways. Without mentioning that you can go to sleep and wake up with huge traffic losses or de-indexed pages usually caused by a penalization. Be careful what you do!

– Link building – On Baidu, it is not about the quality of the publishers’ website, it is more about the unique relevancy of the content (as it relates to your content) and the quantity of links to your pages. Baidu penalizes duplicate content and it also disallows irrelevancy. Authority and quality of the publisher is not that important (for now). In short, the more the merrier as long as it is not duplicate.

– Baidu services – Baidu offers a lot of different products apart of Search; use them and leverage their integrated marketing power. The most useful are Baidu Zhidao (questions and answers service) and Baidu Baike (Wiki service), but there are tons of other services that might be helpful to increase brand awareness and for content creation.

OTHER ASPECTS

As for the tracking, most people use Baidu Tongji and/or Google Analytics. Yes, you read it well; Google Analytics still works in China and it is the only Google service that still does. You will find many detractors, but for what we have seen there is no huge discrepancies between the data collected by both systems (usually not higher than 5%). And Google Analytics has more functionalities than Baidu Tongji.

It is also important to mention the typography. Chinese language is not easy to read due to the difficulty associated to its typography. With 40,000 characters, they are divided in strokes which amount can vary between 1 and 60. Therefore the font size should be at least 12px.

At 2 Open, we would be pleased to help you.Take the advantages the Chinese market offers.

With the cooperation of our Digital Marketing and Ecommerce Agency, China will be at your fingertips.

Do not hesitate to visit us We´d loved to hear from you!

This article has been edited by Paula Vicuña, from 2 Open.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

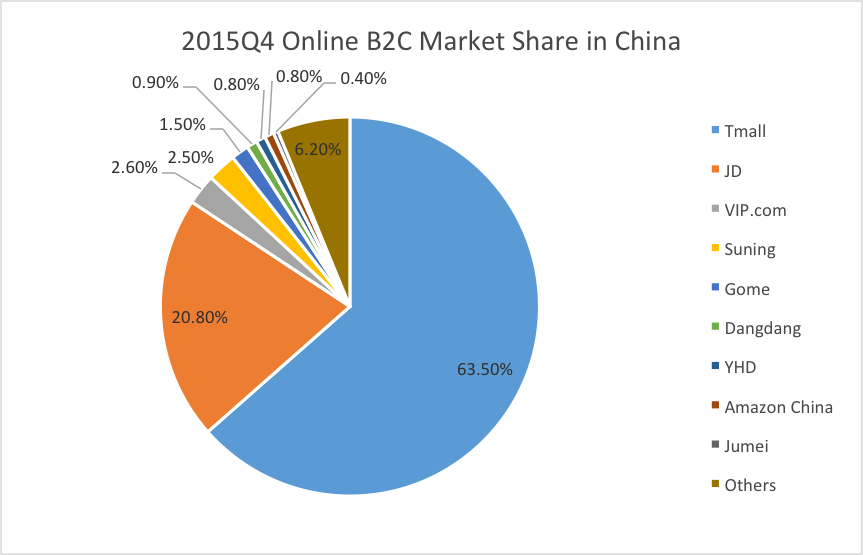

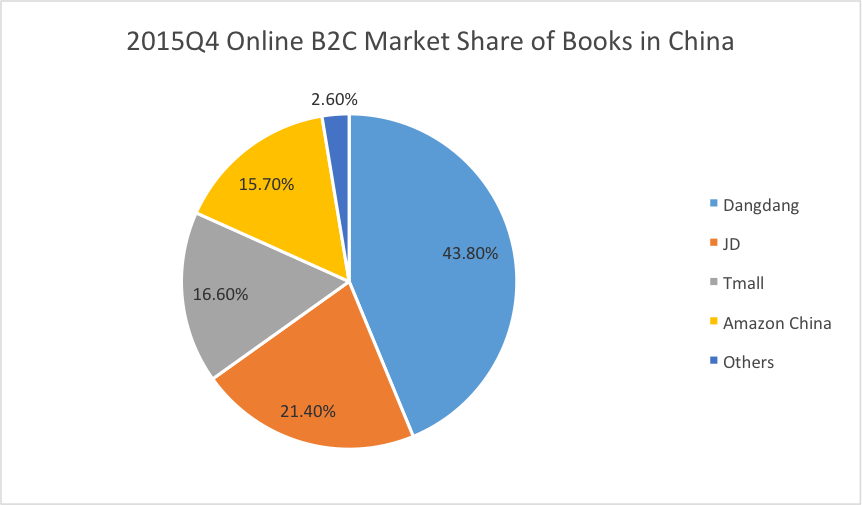

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

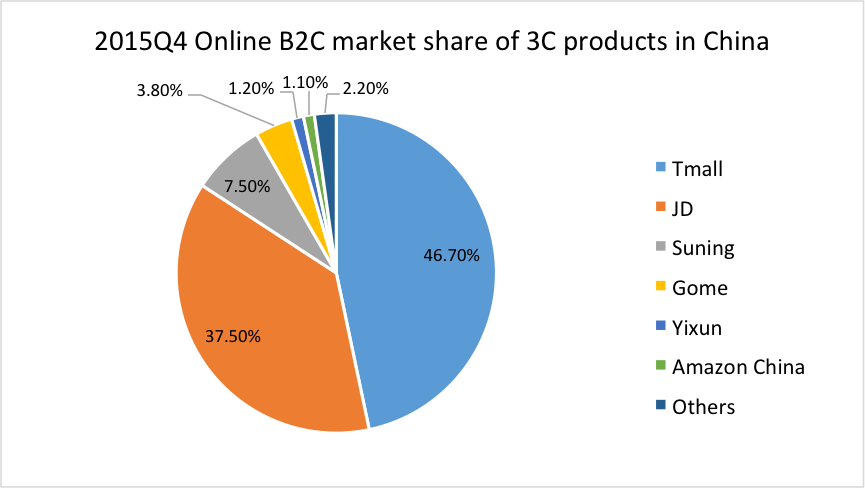

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

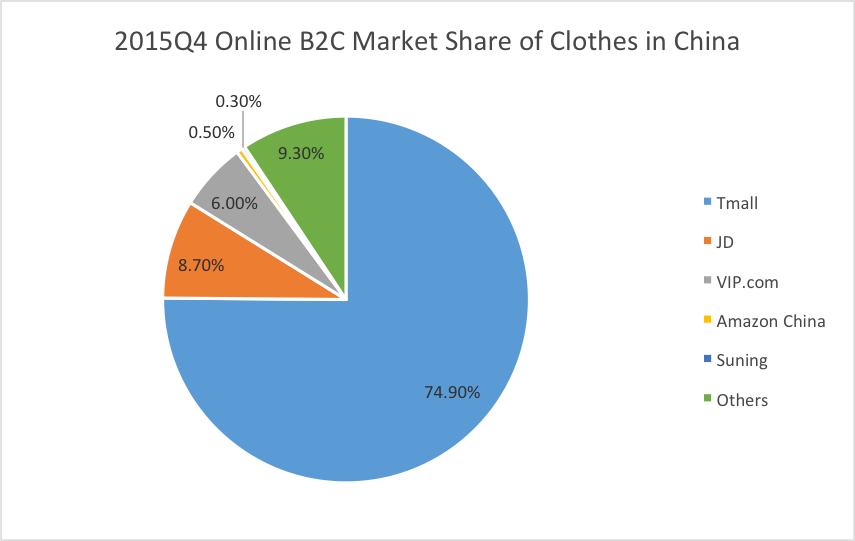

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

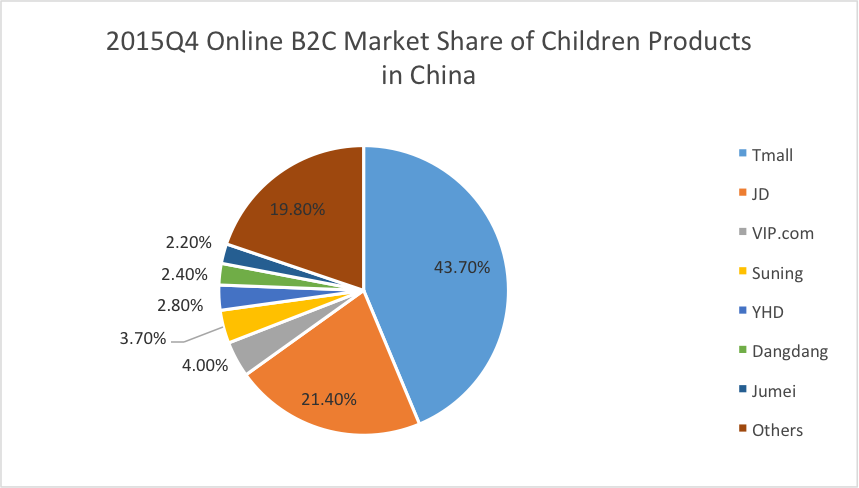

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: