Europe and China Partner to Provide Mobile Payment Solutions by Alipay

Not quite a month we woke up with the news that two technological giants had joined forces in creating an alliance with huge chance of success. The alliance between Ingenico Group and Alipay is focused on payments innovation as part of a wider international push, but is also a recent demonstration of the growing momentum of Chinese companies in Europe.

Over recent years, Chinese ambitions in Europe are clearly visible: just in 2016, Alipay has forged alliances with Uber app and Wirecard to offer mobile payments services around the World.

The alliance is based in European mobile payments

Ingenico Group is a french company specialized in designing a wide range of payment solutions, whatever the sales channel or payment method is chosen, according to three main needs that merchants and consumer ask: a secure, easy and seamless experience.

In recent years, China has created a vast and well integrated digital ecosystem in which highlights Alipay– a Chinese equivalent to PayPallaunch by Alibaba– which is already China’s leading third-party online payment solution with no transaction fees. The company already has more than 400,000,000 active Users.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

The motivation to exploit the partnership is shared: on the one hand, Europe has become the major vacation destination by a sector of the population with high standard of living; on the other hand, Alipay seeks to exploit the existence of more than 120 million Chinese tourists arriving in Europe every year and an approximately cost of $ 875 on average, while offering a payment experience nearest to their day to day.

Chinese tourists in Europe will be able to pay via Alipay App at any store that uses the Ingenico solution

The announcement not only underscores the growing relationship in business between two increasingly interconnected areas, but also the enormous benefits that such collaboration can mean to both. With such a perspective, it is not surprising the happy ending. As Philippe Lazare, Chief Executive Officer of Ingenico Group said,

“We are very excited to partner with Alipay and contribute our unique omni-channel expertise, products and services to help them optimize the user experience and boost sales all over the world. Their choice for Ingenico is a tribute to our high success rate and ability to meet even the most demanding customers’ requirements.”

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

“Payment becomes a friction for business so we are removing this friction by allowing the retailers to capture sales to the Chinese tourist population.”

The measure therefore seeks to stimulate Chinese people expenditure in their major holiday destination, but also tries to take advantage of the huge market Alipay already has in China: more than 450 million users liable to become target audience, and a market share in mobile payments in China higher than 80%. As they themselves spelled out,

“We are building international business step by step. There is much still to do with our customer base, and is still expanding.”

Such collaboration not only benefits the Chinese people, but also means a qualitative leap in technological enjoyment for Europeans. The alliance seeks to provide to European online retailers and to customers the possibility to pay and accept payments through Alipay´s eWallet through some marketplaces. An excellent way to boost e-commerce and sales in China and Europe.

Although the operation has already begun, both companies estimate that Alipay won’t be fully operational in Europe yet.

Just to start

While Alipay makes its movements, the rest of the world watches. Only companies that have a deep understanding of Chinese market can cope with the changes that are to come.

In search of accurate and personalized information to your sector and business?

Visit our Digital Marketing and eCommerce Agency!

Sources:

Why China E-commerce Goes So Fast?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest Ecommerce market in the world, it is also the most changeable one.

From 2 Open, we want to enable your approach to China giving you some practical guidelines about the current state of Ecommerce in China.

Understanding what is happening in China needs time and a constant willingness to learn: sometimes its fast evolution makes it hard to follow the new trends, other times foreigners just find an incomplete analysis.

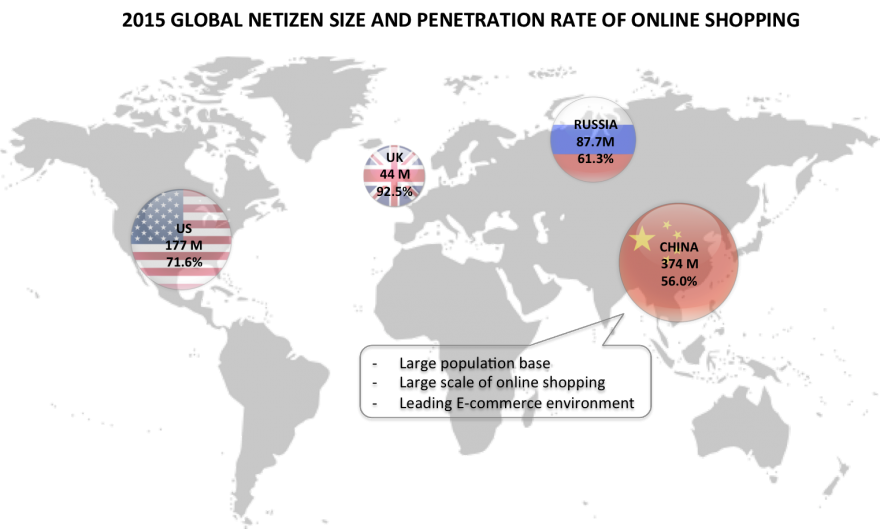

According to the analysis report done by Data Center of China Internet -from now on DCCI-, China has currently taken the first place as the greatest E-commerce country in the world, while the online shopping penetration rate of China is in the second place after United States.

The result of China E-commerce indicates the Chinese economic keystone in recent years, also their development trend of commerce in the future.

As a result, in 2 Open we strongly believe there are more opportunities in the future for E-commerce development.

There are a range of factors we should take into consideration in our approach to the country:

E-commerce market is booming, due to the existence of multiple factors which stimulate the development

In 2015 in China, penetration rate of online shopping reached to 56%. This means there is a huge space to further development comparing with the most-developed countries, and a great opportunity to companies coming to China.

Although there are many factors which are promoting the trend, the main reasons can be summarized in a set of main points:

- Population: Until June 2015, China has 668 million netizens, 594 million mobile phone users and 374 million online shoppers. This leads us to a great size of online shoppers and a strong demand in domestic market.

- Policy: China and its Government have adapted many strategies and measures to promote the E-commerce development. It is a fact that the confluence of two forces have achieved incredible results in recent times.

- Technology: The mature E-commerce relating technologies facilitates the promotion of various industries, especially those related to the Big Data, Internet security, Online payment and Mobile technology. A niche market that is worthy.

- Enterprise: Internet companies have finally joined and distribute to the whole industry, so the result has been that most of the traditional E-commerce companies are transforming to the New Model. Thanks to it, the industry chains of BAT (Baidu, Alibaba, Tencent) cover a large area in China and it is expected to keep growing in future.

- Ecological Integration: The whole industry is getting into a mixture between online and offline industry. Take a look to Alibabas example: they have relied on the industry chain of E-commerce to integrate video, games, travel, finance and other fields into a complete unity. That is the future!

- Basic Infrastructure: Internet infrastructure develops rapidly, especially the Mobile Internet. But also 4G is changing the scene: in the end of July 2015, China 4G accumulated more than 250 million users and 4G base stations were over 1.53 million, of which the construction of TD-LTE base stations were over 1 million. Nowadays, 4G smart phone has already accounted for 82.7% of the domestic smartphone market and seems there is still a gap to fill.

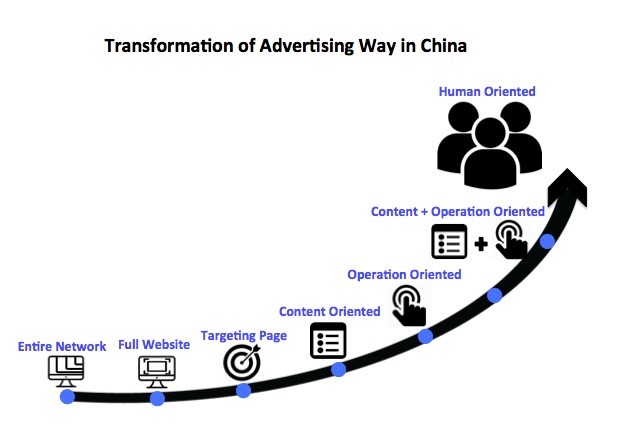

Accommodating to the human-oriented strategy, the E-commerce marketing gets a standout result

With the diversification of E-commerce, the elements influence on the marketing result also became complicated, thus the marketing KPIs should be clear for the marketing themes and goals.

E-commerce marketing has changed from past into a new model of advertising, which is accommodated to the Internet users.

The Model of procedural purchase facilitates the result of advertising, optimizing the convention, and achieves 3 times of ROI:

- The user is the focus: Advertisement position of E-commerce marketing is transforming into human-oriented.

- Procedural purchase is pushing E-commerce marketing into OTG (On-The-Go) model.

Rapid growth of mobile terminal and Big Data brings more commercial values

Now in China Ecommerce market, users, marketing and advertisement investors are in favor of mobile terminal. With the development of mobile technology, the traditional business was greatly impacted.

¿The result? Big Data sharing connects user, product and service together; each data channel communicate with others can release a higher-value data stream.

Vigorously develop of the “festival event”

In recent years, the festival promotion has become an important way of arresting customers. Since November 2011, it has already turned into a battle for the Chinese leading E-commerce companies.

But also the advantage of big data sharing and innovated technology did a tremendous support in the precise marketing and advertisement.

Take Tmall as an example: in 2015, the turnover of Tmall reached ¥57.1 billion just in one day. A huge amount that can still increase.

The tremendous transformation that China lives, cannot be understood without experiencing it by firsthand.

From 2 Open, we have a global perspective and the expertise any company thinking on coming to China needs to develop its business in the country.

If you are looking to take advantage of Chinese Ecommerce, we will be happy to help you.

This article has been edited by Paula Vicuña, from 2 Open

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

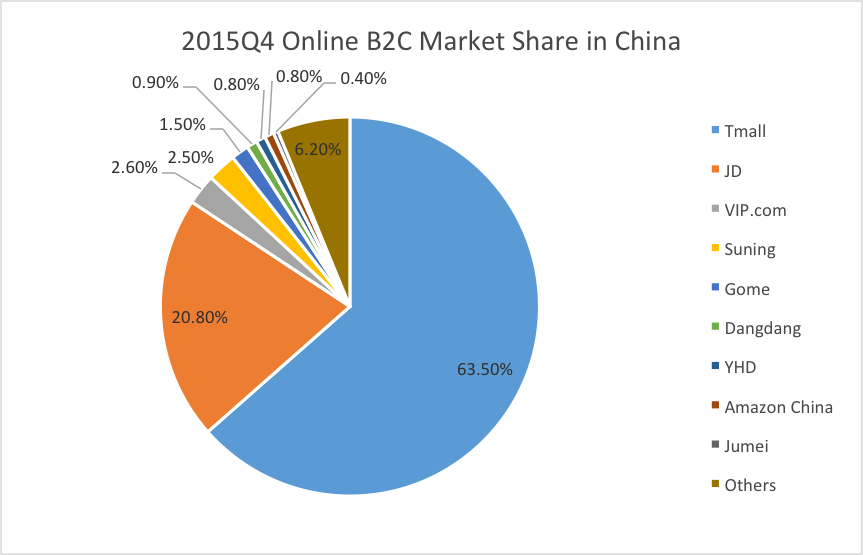

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

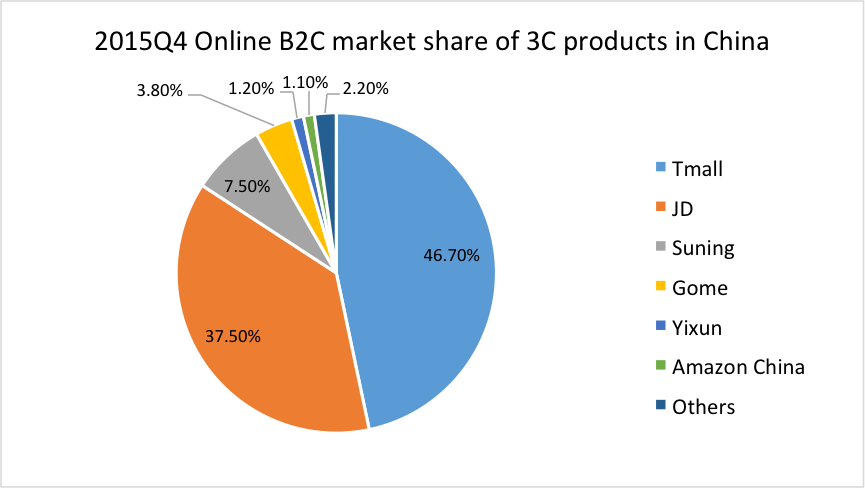

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

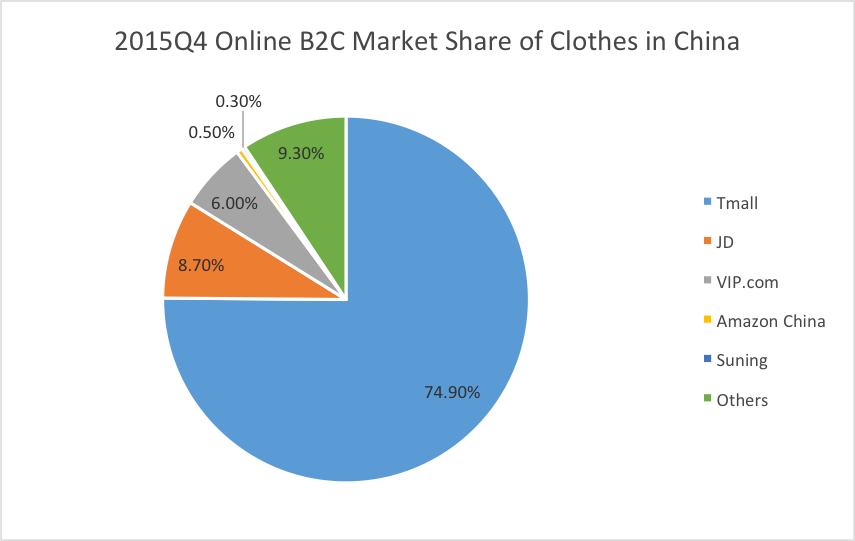

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

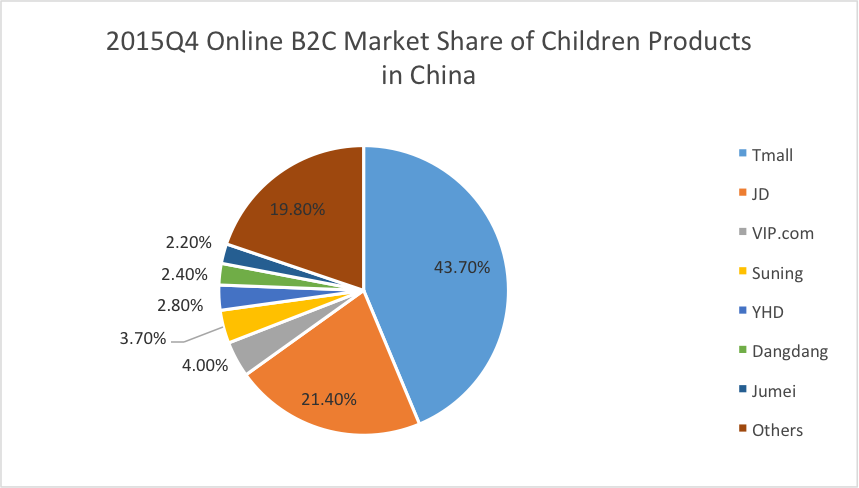

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

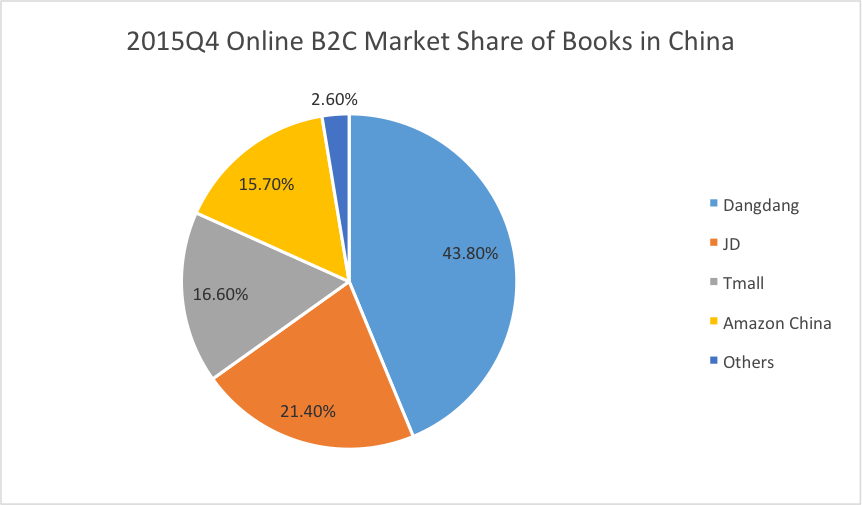

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: