L’Oreal Digital Marketing Campaign in China

In the first half of 2015, L’Oreal’s financial statement reported revenues of 12.82 billion euros worldwide. In comparison with 2014, there was an increase of 14.7%, which is the fastest growth that the company has had in the past 20 years. Its digital marketing campaign was not the exception, with an outstanding 40% increase in online sales, exceeding 1 billion euros; it represented 5% of the company’s total turnover strengthening its position in the online market.

Nowadays, in the cosmetic & beauty industry, 70% of customers search products online before they actually buy them, which means that social media must play a big role in this. Why? You might be wondering, well, the importance of knowing consumer’s needs and preferences enables companies to come up with tailored ads and maximize their marketing budget. Many industries have transitioned from the classic marketing model into its modern version to further understand consumers and optimize results.

It seems that the upcoming era is digital, the society now is constantly connected with their mobile phones, and people are interacting on social media all the time. Most Chinese people love to share moments of their daily life via Weibo or Wechat, these social mobile applications gather a lot of Chinese young people who are potential online buyers, this is one of the main reasons why this new consumption model results so profitable.

Taking all of this into account, L’Oreal, the global beauty brand, keeps track of trends and maintains strong competence in the Chinese online market. The business credo for the marketing industry “where are the consumers, where are we” is practiced well by L’Oreal. In fact, in the digital marketing revolution, L’Oreal is not only expanding its e-commerce channels, they also apply a complete strategy to digital marketing.

All the product and services have to be digitalized

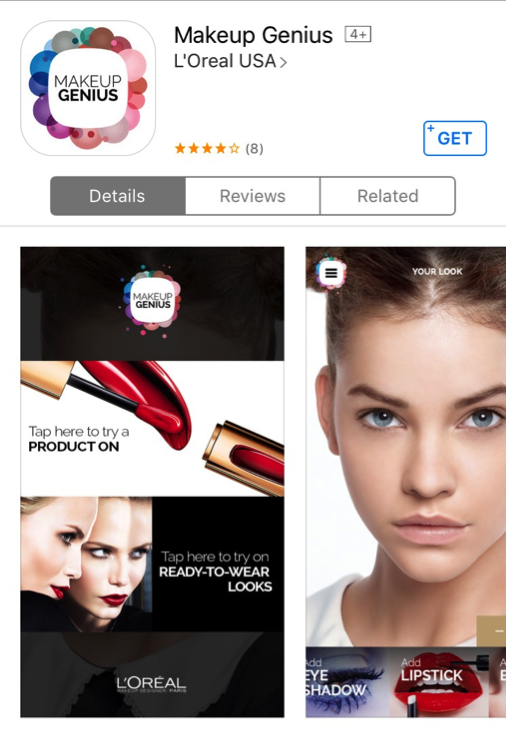

For instance, on the CES conference in Las Vegas, L’Oreal released a patch for sun-induced skin damage – My UV Patch, helps users track real-time ultraviolet exposure damage on the skin with the help of an App. In addition, L’Oreal has also launched a mobile App called Makeup Genius. The App can help users find their own appropriate makeup. Most Chinese people are shy and they do not dare to try exaggerated makeup, with this App users can try hundreds of makeup options and share on various social platforms. In the future, L’Oreal will try to launch more service-oriented App.

-L’Oreal APP for IOS

Digital involvement into every step of decision-making

In the buying decision process, customers experience 4 steps: identifying, considering, purchasing, and sharing. L’Oreal gets involved in every step of the process. For brand awareness, they launched a video advertisement on the entire media platform of Weibo and Wechat. For the decision-making stage they issued a series of makeup tutorial videos on Youku and finally let the users use social media to share their purchasing experience. With this, the entire consumer decision-making process is digitized.

-L’Oreal official account on Weibo and Wechat

Take this case for example, in the 2015 Cannes Film Festival; L’Oreal launched a video advertisement on Wechat, where L’Oreal’s stars would post their pictures and voice message saying “I am in Cannes, will you come? ” and a link to L’Oreal’s e-commerce page. Through this event L’Oreal attracted a lot of fans and potential customers, and the brand’s social influence was digitalized.

-L’Oreal Cannes Event on Wechat

All brands on digital platforms

Based on the first two points, L’Oreal Group including Lancome, Maybelline, L’Oreal Paris and other brands, try to position themselves, as much as possible, on various digital platforms, that is, “where are the consumers, where are we”. Since, nowadays, almost all of the customers are online, L’Oreal has to be searched and discussed as much as possible by customers in order to gain more popularity in the digital world.

-L’Oreal brands on Weibo

When analyzing L’Oreal’s digital marketing strategy, it is worth noticing that this giant enterprise takes digital marketing as a key element of responding to the rising demand among beauty consumers. The O2O (online-to-offline) model gradually drives the enterprise transforming it into a new business model. Digital marketing could not only develop a new market but also help to create a new CRM (Customer Relationship Management) system for other companies. We believe in the future and Chinese digital marketing will become more and more important in the following years.

Have you learned Chinese yet?

If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

Business Theory and Practice in China – Not what you’d expect

Have you ever asked somebody how to do something in China and gotten an unclear or contradictory answer? Worry no more my dear reader, getting to know things before actually doing them in China is extremely difficult, here is why!

Not all questions have a vague answer to them, we are mainly focusing on business related topics, to be more specific, new business models that are being implemented, for instance, WeChat account management, DSP advertising purchases, or cross-border e-commerce are among the main ones that seem to have a variety of answers to them.

Why? You might be wondering, well, these fields are fairly new and still need to mature a bit. This is the main reason why there is no general consensus yet, it basically comes down to who you are asking. A logistics company won’t give you the same answer as the Chinese Customs Administration, nor will an online e-commerce platform or a Chinese businessperson, everyone has a different perspective on the matter, finding out what works for you might be difficult.

In reality, nobody is 100% sure on how things should be done, in fact, it seems like everybody is experimenting with it. The information lacks, is unclear, or contradictory, so you ask yourself, what should I do in order to carry out my business in China?

Your first, and probably wisest option, would be to get in touch with 2 Open, we are used to deal with these types of problems all the time. Facing new challenges and pioneering is one our main strengths and we would be more than happy to help your business achieve its full potential.

Your second option would be to run a pilot test. Getting things right before actually starting is a smart thing to do. Try running some test orders and look at the problems that arise with its delivery process. This will not only give you the knowledge you need but will also let to know the experience you’ll be having later on. Even though this might not be as comfortable to do as it sounds, it certainly is the best way to go about it.

Apart form running this pilot test there is another important aspect you should keep in mind, that is trust. Uncertainty and risk taking are a part of these tests and having an honest trustworthy person on the other end is something that will help you solve any problems you might encounter. Trust issues within your working environment could harm the pace and results of your projects, this is something you might not want to take for granted.

All in all, trust is not enough, you also need to be patient, getting things right requires time and effort. Getting ahead of yourself without the knowledge required could costs you some precious time and money. Plan things ahead and gather all the information needed in order to succeed in the volatile Chinese market.

At 2 Open we have the experience and knowledge to develop your business in China. We not only know how solve problems but we also take that uncertainty on your behalf. Our team is passionate and enthusiastic about every project, our goal is to understand our clients business needs in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

Don’t forget to subscribe to our monthly Newsletter.

This article was edited by Andres Arroyo Olson from 2Open.

All you need to know about Ecommerce in China

The first quarter of 2016 is already behind us, are you still figuring out how to start your e-commerce business in China? For some of us e-commerce still feels like a new business model, however, China has long passed this stage, various data suggests that it has already become a traditional industry in China. Traditional or not, let us sort out the current e-commerce situation and forecast its areas of development.

Ecommerce is on its way to become a traditional industry in China

Ten years ago the ecommerce in China was brand new. Taobao was the most popular C2C online platform. At that time, people who had the technical skills and knowledge of search engines could get over 80% of return of investment on a Taobao shop. Nowadays, Taobao offers more than 1 billion products, has over 10 million sellers, and around 320 million active users. These huge numbers only come from one of Alibaba Group’s marketplace so you might be able to reckon the whole picture. After ten years high-speed development, China’s ecommerce is not a new industry anymore; its development is now as mature as the real estate or the catering industry.

Traditional industry vs Ecommerce

In recent years, the traditional industry has been strongly affected by the online market, some companies have managed to adapt their business to the new online scene, but some have failed at this task. This trend of transitioning from offline to online businesses will speed up this year, and although there are currently more traditional businesses than online ones, online businesses will eventually catch up.

It seems that both business models cannot co-exist, however, if the resourceful traditional industry would explore Chinese digital marketing and ecommerce solutions, they would be able to achieve better results with half the effort.

Develop a 020 (Online-to-Offline) business model

In coming years, online retailing will be a fully integrated part of the market, it will help companies grow, and sale more efficiently. On the other hand, they will also have to implement the offline part of it, a successful integration of a good O2O business will, without a doubt, thrive in market. Suning began handling deliveries for Alibaba, in order to push Tmall Supermarket into the massive market, and Jingdong is promoting Jingdong Daojia, all the actions from the leading Ecommerce companies indicate that the O2O model is inevitable to come.

Ecommerce in the rural areas

Last year ecommerce in rural areas had a rapid development. Alibaba made a long-term project to promote online shopping in order to expand its business coverage. The central government formally issued a document to help the promotion of rural ecommerce and facilitate the integration of online and offline. Alibaba, Jingdong and Suning are also pushing the development of ecommerce in rural areas so we should expect an huge increase this year.

Great development of CBEC (cross-border ecommerce)

Over the past 2 years, CBEC has become one of the most popular business models in China. It has given import business a lot of opportunities; moreover, since the Chinese middle class has grown considerably (first place in the world with over 100 million), it turns out to be a very profitable business. The main consumers are people between the ages of 30-40 and have great acceptance for foreign products, this will bring a lot of overseas ecommerce companies into the Chinese market.

Here at 2Open we specialize in ecommerce and digital marketing. Our goal is to understand our clients business needs in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

It’s official! Taxation reform will start on April 8

On March 24, 2016, the Ministry of Finance of the People’s Republic of China released an article on its website to finally put an end to the on-going rumours. Turns out that all the gossips were right all along, so brace yourselves because the taxation reform for imported retail products through cross-border e-commerce is coming.

According to the article approved by the State Council, starting on the 8th of April 2016, China will implement the import tax policy for cross-border e-commerce retail sales (business to consumer, or B2C), and also adjust the tax policy on personal postal articles.

Currently, items for personal use are considered to be personal postal articles, these types of items represent a reasonable number of cross-border imported goods and will be taxed according to the new tax policy on personal postal articles. The new personal postal article tax is targeted on non-trade imported goods; it combines tariffs, import VAT and consumption tax. Generally speaking, the tax rates of personal postal article tax will be lower than those of imported goods for trade.

Products for cross-border e-commerce retail sales are imported through postal channels and these work differently than the traditional trade of files and correspondences, this is the main reason why unfair competition exists between cross-border e-commerce retail imports and general trade imports within the same category. This is the main reason why cross-border e-commerce imported goods will be considered as merchandise and charged with tariffs, import VAT and consumption taxes.

As a response to consumer’s reasonable demand, the single transaction limit for cross-border e-commerce retail goods will be increased from 1000 RMB to 2000 RMB, furthermore, the annual limit will also be increased to 20000 RMB. For cross-border e-commerce retail goods within the 2000 RMB price limit the tariff will be 0% with an import VAT and consumption tax of 70 % of the current statutory tax. As for the goods that surpass the single transaction or annual limit, they will be charged with full taxation under the general trade model.

Taking into account current regulatory conditions, for the moment, only cross-border e-commerce retail imports that can successfully provide trading, payment, logistics and other related electronic information, will be taken under the scope of the new policy. Personal belongings and imported goods that are unable to provide related electronic information will remain subjects to current regulations. Meanwhile, to optimize the taxation structure, simplify customs declaration and tax payments, and improve customs clearance efficiently for passengers and customers, China will adjust tax policies on personal postal articles. The changes include a reduction from the current four tax items (tax rates: 10%, 20%, 30% and 50%) to three. Under the new policy, tax item 1 is mainly for commodity from MFN with zero tariffs; tax item 3 is mainly for high-end commodity with consumption tax; the rest will be subject to tax item 2. Tax rates for the three new tax items will be 15%, 30% and 60% respectively.

We will have to wait and see how this affects cross-border e-commerce in the following years. Any enquiries you may have about how to increase sales and manage a successful ecommerce business model do not hesitate in contacting us. Our group of specialist will be more than happy to assist you.

This article was edited by Andres Arroyo Olson from 2Open.

References

http://gss.mof.gov.cn/zhengwuxinxi/gongzuodongtai/201603/t20160324_1922972.html

What you need to know about Cross-Border ecommerce for China

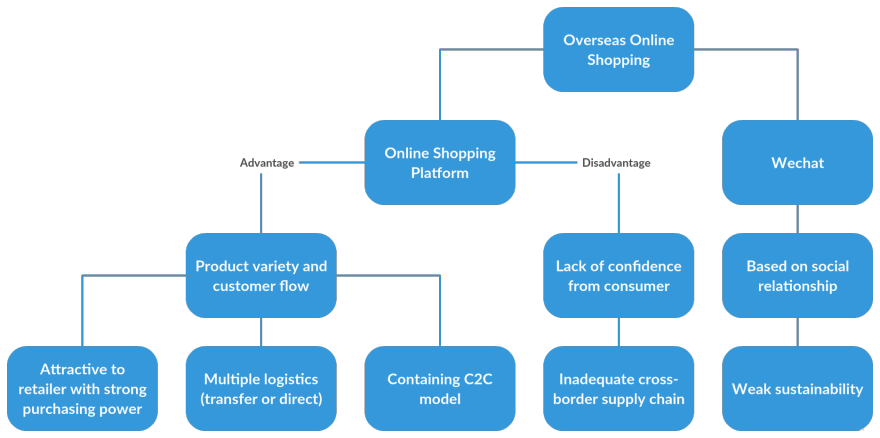

Nowadays cross-border ecommerce is in the rise in China. It seems to be a viable and legal way to import or export products into or out of China avoiding significant tariffs and quotas. Apart from the traditional model of cross-border ecommerce, that is, overseas online shopping, we have classified 4 specific operational models of cross-border ecommerce according to their different business schemes.

- Overseas online shopping

- Direct delivery platform

- Self-support B2C model

- Guide and rebate shopping model

1. Overseas online shopping

Overseas online shopping is perhaps the one that is most familiar to Chinese consumers. It is a sort of procurement service for people who want to buy the overseas products. Consumers purchase the products from foreign retailers or individuals on web pages or mobile apps, and then they get the product by transnational logistics. There are two major ways so accomplish this.

Online shopping platforms

One of the main points an online shopping platform has to do is to attract third-party sellers who meet the logistics requirements. Sellers settled in the platform usually have overseas purchasing power; they regularly purchase the specific product based on consumers’ needs and after the order is received from the customer they transport or mail the product directly to China. This is a typical example of a C2C model, the online platform profits from access fees, add-value services, and transaction fees imposed to the seller.

Representative platforms: G.TAOBAO.COM/JD WORLDWIDE/USASHOPCN.COM

Wechat “moments”

“Moments” in Wechat is becoming a popular way for promoting products online. Although its warranty is mostly based on social relationships, fraud could also occur. With customs restrictions the service would be regarded as smuggling, so there still time to wait for the integration of it in the overseas online shopping environment.

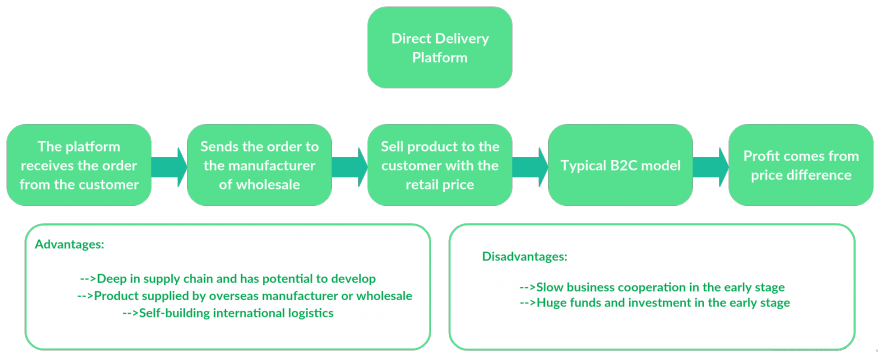

2. Direct delivery platform

Direct delivery platform, also named “dropshipping”, is a model in which the ecommerce platform sends the order from the customer to the manufacturer or wholesale directly, then the latter delivers the product to the customer according to the information provided, it is important to notice that the product is sold with its retail price. Because the end-supplier is the brand vendor/factory, this model could be considered a B2C model. In this case, most of the profit for the direct delivery platform comes from the price difference between the retail price and the wholesale price.

Representative platforms: TMALL.HK/YMATOU.COM/KJT.COM

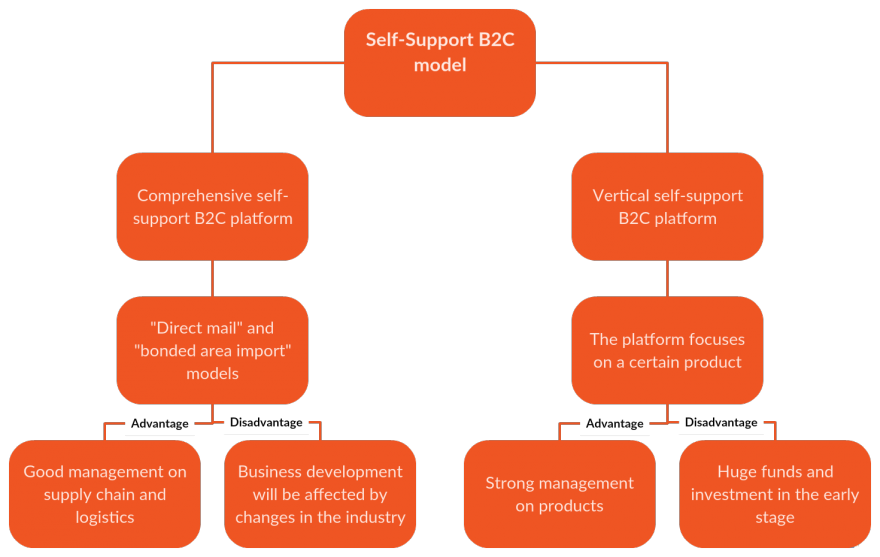

3. Self-support B2C model

When it comes to the self-support B2C model, most products need to be prepared by the online platform before shipping. There are two types of self-support B2C platforms:

Comprehensive self-support B2C platform

For now the only leading comprehensive self-support B2C platform is YHD.COM, which is supported by Amazon and Wal-Mart.

Vertical self-support B2C platform

This model means that the platform focuses more on a certain area to choose the product category, such as food, luxury product, cosmetic or clothing.

Representative platforms: WOMAI.COM/MIA.COM/SASA.COM

4. Guide and rebate shopping model

For a simpler understanding we will split this topic into two parts, the conduction part and the transactional part. Conduction refers to all the means and channels through which customers are led to the product or service: news, online forums, blogs, or ads, all constitute a part of conduction and focus on attracting the consumer. As for the transactional part it involves the submission of the order to an overseas retailer and any monetarily transaction that comes with it.

In order to guarantee product quality and adequacy, this types of platforms usually cooperate with an overseas ecommerce group. Normally the guiding/rebating platform in China joins their pages with the overseas ecommerce pages and once the transaction is done, the overseas ecommerce gives about 5%-15% commission rebate to the Chinese platform. Later the guiding/rebating platform refunds part of the commission to the customer.

One of the main advantages of this model is that the integration of new products and the development of the business itself are relatively simple. Also, because it is a joint between two online platforms, the conduction part results more rewarding since both parties can attract a huge number of customers in a short amount of time and meet the customers’ demands.

As for the disadvantages, long-term projects might be a bit more difficult to carry out since the business depends on two separate ecommerce platforms. Management of the supply chain could also become a problem due to distance and time zone differences.

Representative platforms: ETAO.COM/HAITAOCHENG.COM/123HAITAO.COM

Cross-border negotiations seem to bring a lot of advantages if one is intending to do business with China. Choosing the right model for your business’ needs is crucial for the growth and success of it. Here at 2Open we have plenty of experience with these types of business models and our team of specialists will be more than happy to assist you with any enquiry that you might have.

This article was edited by Andres Arroyo Olson from 2Open.

All you need for your Chinese Landing Page

Landing pages have become more and more relevant over the past few years. With an increase in brand awareness and persuading power, they play a huge roll when it comes to online marketing and ecommerce. This article will focus on the basic structure of a successful landing page as the improvements that can be made to achieve better results.

What is a landing page?

Landing pages are often called guide pages, in general terms, a landing page is the first page that appears when a user enters a website, this could be either the homepage, product page, about us page etc. The channels through which the user enters the website are in most cases clicks on advertisements or results or search engines. There are a few things a landing page has to achieve and although it depends on its business scope, their aims can be simplified in the following way:

-Invite users to keep visiting

-Lead users to make a purchase

-Get users’ personal information

-Invite users to share or to comment

-Other activities, which can bring interactions, etc.

What does a landing page consist of?

Usually a landing page consists on 4 main parts:

- USP (Unique Selling Proposition)

- Core media

- Detail explanation

- CTA (Call-To-Action)

- USP (Unique Selling Proposition)

This is what we call “selling point”. In China, a lot of companies consider this as their core competence. It is a way of distinguishing yourself from other competitors; this is where a company presents its most attractive features about the products or the services it provides. It should basically answer the question: Why should consumers hire my services or purchase my products instead of the others in the market?The main headline of the landing page is also of great importance. It should be a sentence that explains your USP and it should attract the users’ attention. It is basically the first thing users read when they arrive in your landing page so therefore it must be concise and catchy.

- Core media

Media has been used to enrich a landing page, making a page more attractive through the use of pictures and videos or animations.When people are watching a webpage, an interesting picture or video can leave a better impression than a sentence.

- Detail explanation

This is a main part of your landing page. Here you need to put more detailed information to support your USP. It could be points that further explain in a more detailed way the main value proposition of your service or product. It could also include advantages of what your are providing the customer as well as useful real life examples that will continue to support your USP.

- CTA (Call-To-Action)

This is the deal-sealing part of your landing page. It should not be difficult for a customer to complete the purchase of the service or product at any given moment whilst he/she is viewing your landing page. It does not matter if it is a button, a link, or a form; you just have to make sure that it is obvious and eye-catching. Users must know exactly what they are doing on your webpage and all the relevant information that comes with it, both monetarily and logistically.

To sum up

We might take for granted the elements of landing pages, consumers do not really notice all of the work that has been put into a webpage, but as long as you would like to have a successful one, you should pay better attention to these details and think on creative ways to improve them. Nobody starts from the top, so why not give it a try and see how a good landing page can benefit your business?

If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

References:

Online to Offline (O2O) in China

E-commerce has grown internationally over the past few years; China is one of the countries with the fastest e-commerce growing market, Alibaba has become the largest business-to-business (B2B) platform in the world. Tmall is the largest business-to-customer (B2C) website in Asia, with more than 90 billion RMB in revenue recorded on Nov 11, 2015(China’s “Singles Day”). Despite their success, return rates have also grown accordingly. Compared with offline physical shops purchases, online shops experience a higher rate of refunds and exchanges. The lack of the buyer experience is perhaps the biggest weakness of e-commerce, that is the main reason why the online to offline (O2O) business strategy was created.

O2O is a business model where companies attract potential buyers to their physical stores through online marketing strategies. These strategies often consist in in-store pick up of items purchased online as well as offering the option of buying or experiencing the items directly at the store.

Fast moving consumer goods do not really have to offer the buyer experience since they are expected to sell quickly and for a low price, this is the main reason why O2O does not really suit this field. Durable consumer goods, like clothing, seem to have a huge potential, they are probably the best candidates for the implementation of O2. Let us say, for instance, that you would like to buy a new camera, you compare all the features of several models online, experience them in physical shops and then after you finally decided the model, you would simply place order online for a reasonable price. Everything fits perfectly. There has been an ongoing talk about this for years, Manufacturers know this, they would like to see this, but unfortunately results are not ideal.

Why is it so difficult for O2O commerce to evolve? Who has the advantages to start implementing an O2O business model? Should large Manufacturers, like those who own multiple shops, implement it? Should offline chain shops do it? Logistics companies? Online platforms? These are questions that have to be discussed. Let us talk about these one by one.

Most Manufacturers with lots of physical shops operate offline, they usually carry out the traditional business scheme; they manage shops and focus resources on shops rather than the end users. Very few manufacturers have their own Customer Relationship Management (CRM) system for consumers, and even when they do, what happens to the employees at the shops? Sales volumes usually measure commissions and performance for employees, however with an O2O business model it makes it harder for manufacturers to keep track of their physical shops and employees performance. No companies have solutions for this, so employees in physical shops resist O2O, so for manufactures O2O is harder to be executed.

In the case of offline chain shops, employees manage products rather than sell them directly, and they have CRM systems for most of the consumers. The real problems these companies face is related to online traffic, do their offline consumers also have the habit of buying online? Even if they do, do they know the chain shops started an online business? Despite the attractiveness of implementing a fully online business, they are still more likely to succeed with a O2O business model. Suning is a real life example of this, with thousands of offline physical shops of household appliances, also expanding its categories one store at a time, and being the third in the Chinese E-commerce field. Their market share is a little more than 3%, far behind the first two companies, O2O is the trend but there is still a long way to go.

What about Logistics companies? Logistics means warehouses and more detailed consumer data; this is the main advantage here. SF-express started Hi-ke in 2014; the goal was to steal market shares from online platforms like Tmall and JD with SF-express’ logistics. This resulted in a lack of experience for consumers and complex order placing procedures.

Online platforms should also implement O2O for one reason, to keep the current e-commerce market share. Tmall and JD just started this; we will have to wait to see how it works out. Their weakness is still the lack of physical shop operation experiences.

O2O needs someone who can successfully implement the business model, in China currently there has been no one who had manage to do this, it seems that what the market needs is a pioneer in this field, future is bright, and the market gap is there, let us wait and see who will rise up.

This article was edited by Andres Arroyo Olson from 2Open.

7 Facts You Need to Know About The Chinese Online Market

1. The Chinese online ecosystem is shaped by the actions of the B.A.T.

The B.A.T. is a group consisting of Baidu, Alibaba and Tencent. They are the dominant players in the Chinese online ecosystem. The dynamics of their competition and cooperation defines the boundary and possibilities of digital marketing and ecommerce in China. Each member of the B.A.T. dominates important segments of the online ecosystem: Baidu dominates the search engine market; Tencent is strong in social media, and Alibaba fiercely rules ecommerce. The results of this competition can provide inconveniences for online marketers. Baidu, for instance, is reluctant to direct search traffic to Tmall stores and pages, where in some cases a company will need special permission from Baidu to promote Tmall stores using Baidu’s Search Engine Marketing (SEM).

2. Baidu’s dominance in the search market

Baidu’s dominance in the Chinese search market means that most search engine related marketing activities requires the cooperation of Baidu to work. Baidu’s Search Engine Optimization (SEO) is different from Google’s SEO. Baidu still requires Meta data for proper indexing and it prioritizes loading speed quite heavily. Setting up SEM accounts with Baidu can either be an easy task that lasts for several working days or an excruciatingly slow and cumbersome process, which might take months to complete. This depends on the involved company’s policy match with Baidu’s requirements. There is also a minimum investment requirement for setting up an account. These can range from as low as 6,000 RMB to as much as 500,000 RMB depending on the type of account that is being opened. One of the most important aspects of Baidu’s listing is the absence of brand protection. This means that brand keywords can be bought by any paying parties willing to buy them. This might lead to unfair price based competition between official suppliers and the unofficial ones, or even from someone that sells fake products through proper channels.

3. Wechat is not just a messaging app; it is a lifestyle app that defines online interaction in China

It is hard not to know about Whatsapp, Facebook, Twitter or Instagram in 2016, yet many are not familiar with Wechat if they live outside of China. Many foreigners regard Wechat as a Chinese version of Whatsapp but it is far from just a messaging app. To be more precise, Wechat combines the function of many known social media sites and utility apps. Users can chat, post their photos, sell items, make online payments, book a ride, buy transportation tickets, invest their money, and more. In addition to being used as a private app, it’s becoming more and more popular in the work place, mainly used for communications. With so many diverse functions and over 600 million registered users, marketers naturally want to use Wechat as a channel to communicate to their target audience. Wechat offers the possibility of a one on one customer service; creating customized functions to improve the brand experience. However, with the Wechat craze comes the high costs of Wechat marketing. Posting merketing content on a big account with upwards of 100,000 followers can cost as much as 80,000 RMB.

4. The Chinese consumer has embraced ecommerce faster than most markets

The rise of ecommerce in China surprised many outside observers. Many consumers born in the 80’s and 90’s have fully embraced the concept of ecommerce as the main way to purchase items. Anything from daily necessities to premium products can be purchased. The Chinese consumer responds well to online promotions and acceptance of new brands, however, most of them are still price sensitive. Foreign brands selling in the Chinese market to the Chinese consumer are less likely to be successful offline due to the high cost of real estate. Platforms such as Tmall and Jing Dong and vertical e-store are the best way to sell to consumers in China. Ecommerce events such as 11.11 are already a cultural phenomenon in China where the total transactions can be above 11 billion USD in one day.

5. China has one of the most highly regulated online environments in the world

China is one of the fastest growing online markets yet it is one of the most regulated ones. Traffic data going in and out of the country is heavily censored and is significantly slower than domestic traffic. This means that local hosting might be necessary for optimum speed. To publish a website, a company is required to obtain the Internet Content Provider (ICP) license to publish any content online. China has a very strict advertising law. Multinationals are regularly hit with fines for violating the law and some fines can go up to 100 million RMB. It is critical to study the proper regulations and laws before entering the Chinese market to prevent future risks and losses.

6. Mobile is not the future; it’s already the dominant traffic in China

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

7. Local content through local perspective

The Chinese market is still flooded with marketing contents that are just a direct translation from their original language. Some branding videos of multinational companies do not have Chinese voice-overs, only Chinese subtitles. While these contents do not necessarily fail to communicate their intended message, most have drastically reduced their effectiveness and recall rate due to being less relevant. In order to communicate effectively, companies need to dig deep to find relevant messages and hire local content producers as a bridge to effectively communicate to their Chinese consumers. This is especially relevant when publishing materials online, where the Chinese consumer expects instant gratification, not a bad translation.

This article was edited by Andres Arroyo Olson from 2Open.

2Open on Spanish radio: Business in China?

Recently, we were invited to a local Spanish radio program called “Onda Cero” in Cáceres City. Vicente Pozas, the host of the show, asked some interesting questions to our colleague David González regarding Digital Business in China. For a lot of people in Europe, China is a far away land with a different culture, different people, and different ways to make business. People are getting interested in China, it has had a huge economical growth in the past few years and interest of foreigners has grown accordingly.

The talk mainly focused on China’s development in certain technological areas, the business opportunities it offers, and the considerations that have to be taken into account if one should intent to do business in China. David González talked about the differences in population of major cities in both countries and the way e-commerce in China has surpassed any other country in the world. He also stressed the way the Chinese middle-class people have gained more purchasing power and how all of this can be translated into a broader potential market for any business.

After throwing out some interesting figures about China, he talked about failure and success cases that foreign companies have had when trying to enter the Chinese market, the limitations and the room for mistakes that exists in the country, and the complexity of making business with a Chinese businessperson.

Although the talk focused mainly on China and the way they make business, David got the opportunity to talk about 2Open, our business values, and the way we carry out every project with passion and commitment. The complexity and the obstacles that a business in China could present and how a company like 2Open can make the whole process a lot simpler and successful.

Here is the audio of the interview with David González on the Spanish radio show “Onda Cero”, sadly the audio file is only available in Spanish, but if you have a particular interest on it please leave a comment and we will post an English translation of it.

This article was edited by Andres Arroyo Olson from 2Open.

Top 5 Chinese payment gateway for your website

The market of e-commerce stand alone websites growing very fast in China. In order to have your own e-shop website you need to consider to get a good payment gateway to accept your payments online.

Everyone who is new to ecommerce will tell you that the most difficult task is not only to decide which platform is the best one but also the different factors that you need to take into consideration when deciding which gateway best fits your needs. Choosing a payment gateway can be difficult, there’s a lot of competition, a lot of confusion and a lot of data to figure out before you can work out which payment gateway to choose. So we’ve decided to describe five of the most popular options to help charities see if we can try and help narrow down which Chinese payment gateway is the best for you: (more…)